Rent vs Buy: Which Makes More Sense Right Now?

If you’ve been asking yourself “Should I keep renting or is it finally time to buy?” — you’re not alone. With mortgage rates higher than they were a few years ago and rents doing their own unpredictable thing, the answer isn’t as obvious as it used to be.

The truth? There’s no universal “right” choice. But there IS a right choice for you, depending on your timeline, finances, and how flexible your life needs to be right now. Let’s break it down in a way that actually makes sense.

Apartment Living

What the Market Looks Like Right Now

Mortgage rates are still higher than what many buyers were used to just a few years ago, hovering around the low-to-mid 6% range in late 2025.

In most major cities, renting costs less per month than buying — sometimes a lot less.

Buying still makes sense in certain markets and situations, but affordability is tighter overall.

Several recent housing studies show that in most U.S. metros, monthly mortgage payments are significantly higher than rent for comparable homes, even after rent increases are factored in.

sources: Realtor.com, and Bankrate.com

Renting: Why It May Work For Some

Renting gets a bad rap, but it’s actually a smart move for many people.

Why renting can make sense:

Lower monthly cost: In many cities, renting is still cheaper month-to-month than owning.

Flexibility: If your job, family situation, or plans could change, renting keeps your options open.

No surprise expenses: When something breaks, it’s usually not coming out of your pocket.

Downsides to keep in mind:

You’re not building equity

Rent can increase over time

Less freedom to customize your space

Renting works especially well if you’re not sure where you’ll be in the next few years or if you’re prioritizing cash flow and flexibility.

Apartment Interior

Buying: Worth It, But Timing Matters

Buying a home can still be a great long-term move, but it’s less forgiving if you’re not ready to stay put.

Why buying might be right for you:

You’re planning to stay in the same place for 5+ years

You want to build equity instead of paying rent forever

You value stability and having full control over your space

Challenges buyers are facing now:

Higher interest rates mean higher monthly payments

Upfront costs (down payment, closing costs, repairs) add up fast

Short-term ownership can cost more than renting if you sell too soon

Buying tends to work best when you’re financially prepared and emotionally ready to settle in for a while.

Couple Moving Into New Home

Ask Yourself These 3 Questions Before Deciding

Instead of focusing only on rates or prices, ask yourself:

-

If it’s under five years, renting often wins. Longer than that, buying starts to look better.

-

Think property taxes, insurance, maintenance, HOA fees, and unexpected repairs.

-

National headlines don’t always match what’s happening in your city. In some areas, buying can still be surprisingly affordable compared to rent.

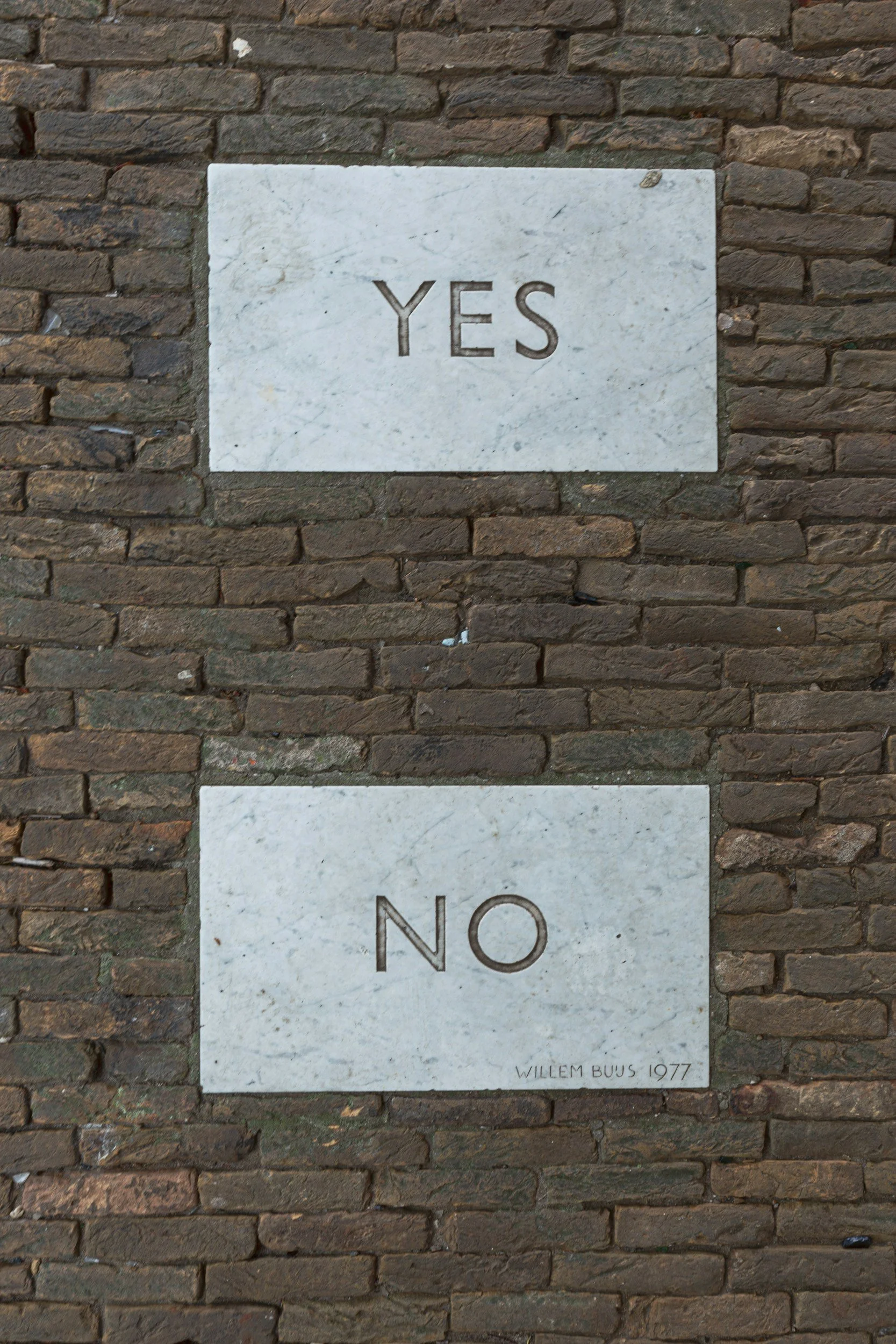

Decision Time

So… Rent or Buy?

Right now, renting makes more sense for many people in the short term, especially if flexibility and lower monthly costs matter most. Buying can still be a smart move if you’re ready for a longer commitment and can comfortably handle today’s prices and rates.

There’s no pressure to rush either way. The best decision is one that fits your life now — not what worked five years ago or what someone else says you “should” do.

Still on the fence? Click the button below to schedule a consultation and talk through your options.